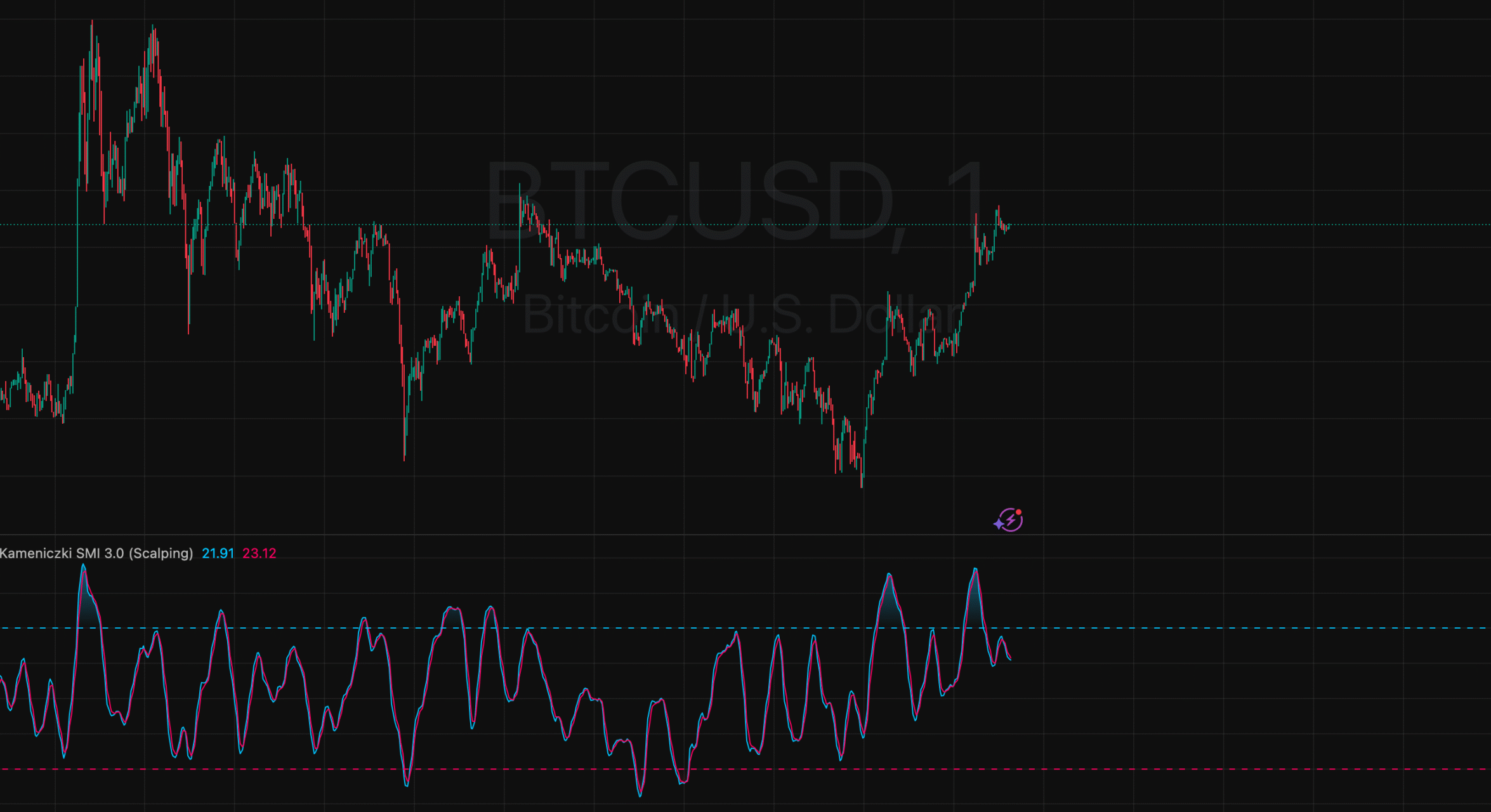

We are proud to announce the release of a new version of our indicator — Kameniczki SMI 3.0. This update introduces the long-awaited Scalping mode, expanding trading possibilities especially for those focused on quick market entries and exits.

The new Scalping mode is designed with an emphasis on high sensitivity and rapid reaction to shifts in market sentiment. In practice, this means that the %K length has been reduced to 5, allowing the indicator to more quickly detect short-term extremes. At the same time, smooth output is maintained thanks to the use of a double exponential moving average (EMA), which helps eliminate unnecessary noise.

Kameniczki SMI 3.0 now offers three trading modes:

- Scalping – short-term signals on minute-based charts (e.g., 1M, 5M)

- Day Trading – medium-term settings ideal for daily trading

- Swing – long-term positions suited for more patient investors

When switching between modes in the settings, the indicator parameters (%K, %D, and EMA) are automatically adjusted, so traders don’t have to configure them manually.

We’ve also preserved the familiar visual elements: gradient fills for overbought and oversold zones, colored SMI bars, and a clear midline. These features make interpreting the indicator intuitive and easy at first glance.

This update is the result of valuable feedback from our community and our ongoing commitment to delivering highly accurate and practically useful tools for modern trading.

We believe the new Scalping mode in Kameniczki SMI 3.0 will help you better time your entries and exits, and improve the accuracy of your trading decisions.