Kameniczki AI RSI Pro v2.0 is an advanced technical indicator based on RSI (Relative Strength Index) with artificial intelligence that provides comprehensive market analysis with emphasis on safety and signal reliability. The indicator combines traditional RSI calculations with modern AI technologies for detecting high-quality trading opportunities.

Key Features:

AI Signal Quality Assessment

– Automatic signal quality rating on 0-100% scale

– Strict filtering to prevent false signals

– Trend confirmation with “falling knife” protection

– Momentum filter for detecting strong trends

Multi-Timeframe Analysis

– RSI analysis across 5 timeframes (5M, 15M, 30M, 1H, 4H)

– Alignment score calculation for trend direction confirmation

– Configurable threshold for MTF alignment (50-90%)

Smart Money Detection

– Detection of smart money accumulation and distribution

– Volume vs. price analysis for institutional activity identification

– Smart money strength calculation (0-100%)

Anomaly Detection System

– Early warning system for market anomalies

– Monitoring of price, volume, and volatility anomalies

– 4 anomaly levels: NORMAL, MEDIUM, HIGH, CRITICAL

– Comprehensive anomaly scoring (0-100 points)

Volume-Weighted RSI

– Volume-weighted RSI calculations

– Adaptive RSI lengths based on volatility

– Three RSI variants: Fast (7), Medium (14), Slow (21)

RSI Divergence Detection

– Automatic bullish and bearish divergence detection

– 20-bar lookback period for accurate identification

– Integration with AI signal quality

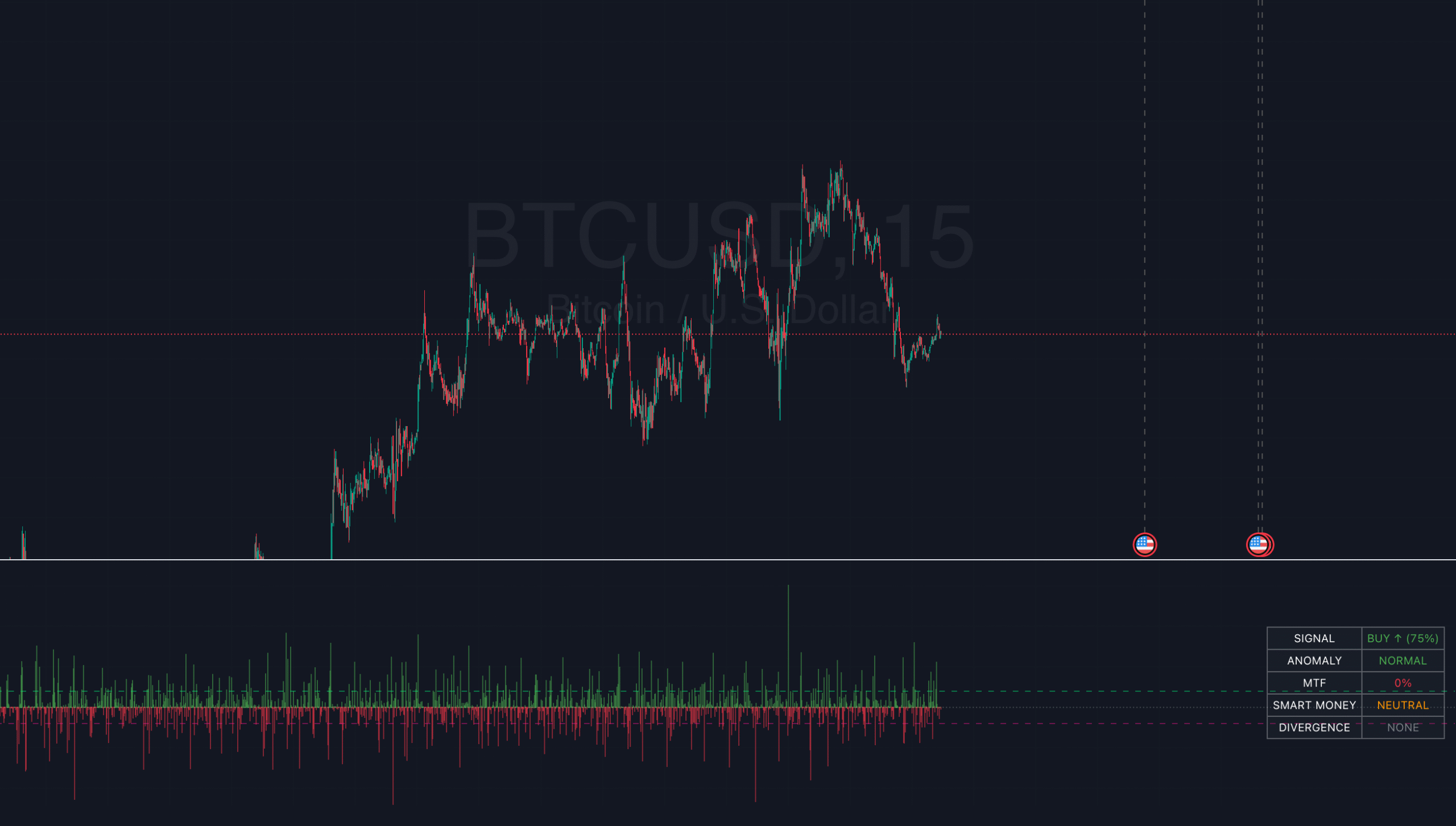

Dashboard and Visualization

Information Dashboard

– **SIGNAL**: Main trading signal with percentage score

– **ANOMALY**: Market anomaly status with color coding

– **MTF**: Multi-timeframe alignment percentages

– **SMART MONEY**: Accumulation/distribution status

– **DIVERGENCE**: Current RSI divergences

Signal Types

– **STRONG BUY/SELL**: Highest quality with trend confirmation

– **BUY/SELL**: Normal signals with percentage score

– **NEUTRAL**: No clear direction

Visual Effects

– Glowing colors for high AI quality (90%+)

– Modern AI color schemes

– RSI momentum histogram

– Critical zones for extreme levels

Settings

RSI Core Settings

– Base RSI Length: 5-100 (default 14)

– Fast RSI Length: 3-21 (default 7)

– Slow RSI Length: 14-50 (default 21)

– RSI Source: Price source for calculations

AI Enhancement

– Enable AI Signal Quality: AI quality rating

– AI Quality Threshold: 30-95% (default 70%)

– Enable Smart Money Detection: Smart money detection

– Enable Volume Weighting: Volume weighting

Multi-Timeframe Analysis

– Enable MTF Analysis: Multi-timeframe analysis

– MTF Weight: 10-50% (default 30%)

– MTF Alignment Threshold: 50-90% (default 75%)

Visual Settings

– Enable Glowing Effects: Bright colors for high quality

– Line Width: 1-5 (default 2)

– Zone Transparency: 50-95% (default 80%)

– Dashboard Position: 6 positioning options

– Customizable signal colors

Alert Settings

– Enable Alerts: Main alerts

– Enable Divergence Alerts: Divergence alerts

– Enable Smart Money Alerts: Smart money alerts

Alert System

Main Alerts (AI Quality ≥ 85%)

– SUPER RSI STRONG BUY/SELL: Highest priority

– SUPER RSI BUY/SELL: Normal signals

– Price, RSI, trend, and stress level information

Specialized Alerts

– BULLISH/BEARISH DIVERGENCE: RSI divergences

– ANOMALY CRITICAL/HIGH: Market anomalies

– SMART MONEY ACCUMULATION/DISTRIBUTION: Smart money activity

– MTF ALIGNMENT: Multi-timeframe alignment

Technical Specifications

Calculation Methods

– Volume-weighted RSI with adaptive lengths

– ATR-based volatility analysis

– EMA trend confirmation (20, 50, 200)

– Stress level calculation (KAMENICZKI AI 1.5.5)

Safety Mechanisms

– Momentum filter against counter-trend trading

– Trend confirmation requirements

– Volume confirmation for extreme signals

– Falling knife protection

Performance Optimization

– Max bars back: 500

– Efficient global variables

– Optimized functions for speed

The Kameniczki AI RSI Pro v2.0 indicator is designed for professional traders who need reliable and safe signals with emphasis on quality over quantity. It combines traditional technical analysis with modern AI technologies for maximum accuracy and risk minimization.